The wisdom of web IPOs.

As a social service reliant on its users is Facebook right to go public and do we as consumers need to be concerned of the potential impact?

Numerous articles exist arguing that the big company ethos that accompanies a public listing ruined Google - it has sold out to its new corporate ideals - and others voice obvious concerns that Facebook will head the same way with quarterly returns and shareholder demands becoming all powerful.

Numerous articles exist arguing that the big company ethos that accompanies a public listing ruined Google - it has sold out to its new corporate ideals - and others voice obvious concerns that Facebook will head the same way with quarterly returns and shareholder demands becoming all powerful.

But is it, in a way, a conflict of interests for a company that relies so heavily on the end user?

People v dollars

It is not in Facebook's interests to put the almighty dollar firmly ahead of the user as the service is ultimately reliant on its user base for business but there has to be a balancing act. While the user should expect certain standards from the company they must also realise that it is a business which needs to make money; there is no such thing as a free lunch (or social network).

Those saying that Facebook will become the most dangerous company around after IPO are, perhaps, scaremongering to a degree but Facebook must still be held to account to ensure that the pressure to succeed doesn't drive it to act in ways that it shouldn't.

To the limits

Facebook has always pushed the boundaries of online acceptability, especially with regards to privacy, and I see no reason why it will - or should - change just because it becomes a publicly traded company.

Many of the advances we see in social technology have come as a result of Facebook pushing the envelope or reacting to the competition. There have also been some major howlers but modern social networking is still a young field and there are bound to be mistakes (from any company) while the limits of acceptability are defined.

Over time these limits morph and, in many cases, recede as society becomes more familiar, and at ease, with sharing online but the rate of change is not the same for all so we must remain guarded.

Keeping watch

One advantage for the user, and conversely a disadvantage for the company, is that going public suddenly means you have a direct accountability to a lot more "owners" (albeit often in small measure on an individual basis).

Unpopular acts committed when privately owned may cause a few thousand dissenters to close their accounts which is but a drop in the ocean to a company like Facebook. When public, on the other hand, a few thousand dissenters could potentially dump their shares causing a direct financial impact due to falling prices.

This accountability will force Facebook to think twice about any overtly risky practices but I hope not at the expense of stifling innovation.

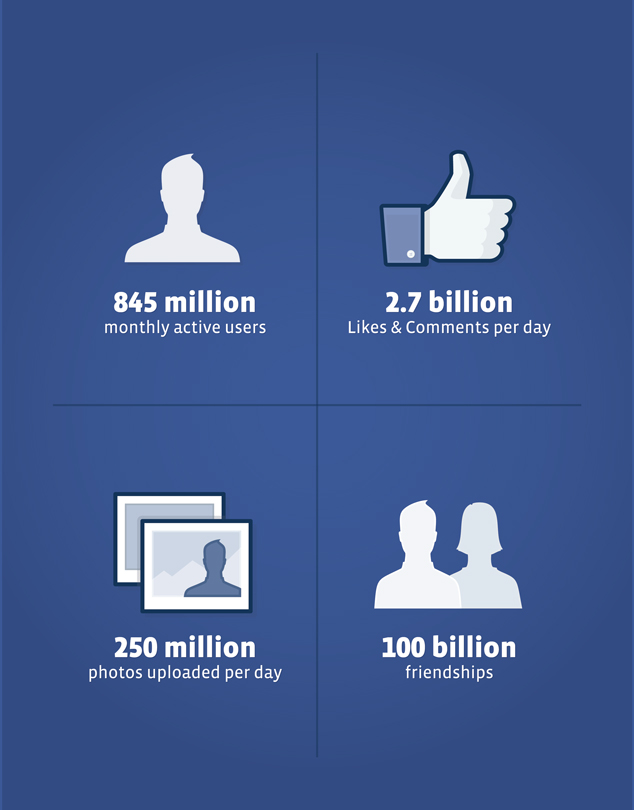

Image from Facebook's Form S-1 Registration Statement

Does Facebook need to directly monetise Instagram?

As web based companies expand beyond their original remit is there a need to directly monetise all aspects of the business or can knowledge gained in one area be applied elsewhere to enhance performance?

Facebook's acquisition of Instagram has a partial similarity to the launch of Google+ in that they are both social properties outside of the core business which can be used for data collection

Facebook's acquisition of Instagram has a partial similarity to the launch of Google+ in that they are both social properties outside of the core business which can be used for data collection

Google and Facebook are both in the information business but their primary business gathers data in different ways: Google via search and Facebook via user-generated/shared content and relationships.

Google launched Plus to utilise the social model of data collection. User content, shares, +1s all help to flesh out the social graph and when linked to the core business of search give Google a much better picture of out likes and interests and real-time trends.

Facebook has one of the largest data collection models going with such a huge range of data being freely offered up by its members. The only problem is that the data is such an amalgam that, perhaps, signal can get lost in the noise despite some of the most complex algorithms around. Instagram offers a different kind of social graph and, as it is more focused, is a good counterpoint to the main Facebook graph.

Monetisation

Google stated that there was immediate plan to directly monetise Plus - there is no need to. The social layer combines signals from right across the Google ecosystem as well as externally due to the +1 button enhancing the core data generated by Search. By using all of this data (and now with the single privacy policy) Google is far better able to target us with relevant advertising in all the locations it has historically done so without having to introduce further ads on the Plus site itself.

Does Facebook need to directly monetise Instagram?

It is widely accepted that mobile is an under utilised resource when it comes to Facebook making a buck but is Instagram the right place to do it? The application is a perfect example of a clean, simple mobile application and its users love it for this simplicity. Does Facebook want to ruin that? Most likely not.

Just as with Google+ would Facebook be able to gain enough data to better target advertising on the website without needing to resort to mobile or, as I suggested, would it make more sense to use the different social graphs both combined for an holistic picture and independently for "per platform" ad targeting based on our use on that platform?

Is this all made irrelevant by the IPO because of which Facebook may feel pressured to directly monetise mobile anyway?

What are your thoughts?

Why not discuss this on Google+ here.

Image by Jeremy Brooks